990-EZ vs 990-N: How to Tell the Difference + Other FAQs

May 4, 2024 | 990 filing | 0 Comments

One of your small nonprofit’s most significant duties is filling out your IRS tax forms. Not only does filing these forms on time maintain your organization’s tax-exempt status, but it also prevents monetary penalties, making it crucial for your organization’s financial health.

The best way to prepare for tax season is by ensuring you understand the basics of annual filing for a tax-exempt organization. Learning the difference between the key tax forms, such as Form 990-N and 990-EZ, is a great way to familiarize yourself with the documents you’ll need to file when the time comes. In this guide, we’ll get you started strong with these essentials:

- What are the main types of nonprofit tax forms?

- Form 990-EZ vs 990-N FAQs

- How can I eliminate anxiety surrounding nonprofit taxes?

Ready to find out the differences between these forms and how to ensure your organization stays up-to-par with the right documents? Let’s get started!

What are the main types of nonprofit tax forms?

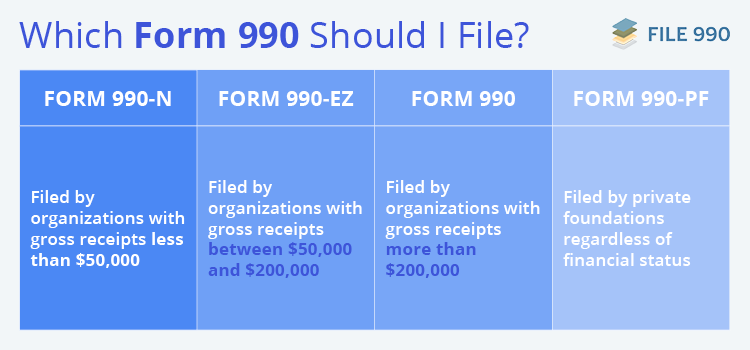

The four most common variations of the IRS Form 990 are the standard Form 990, Form 990-N, Form 990-EZ, and Form 990-PF. Although they all share the same basic function of ensuring financial transparency and accountability, there are a few key differences between these forms and the organizations that file them. Let’s look into each type of form based on the financial size and organizational makeup of your tax-exempt nonprofit:

- Form 990-N, also known as the e-postcard, is the IRS’s electronic form for tax-exempt organizations with annual gross receipts of less than $50,000.

- Form 990-EZ, the IRS form required for midsized tax-exempt organizations with annual gross receipts between $50,000 and $200,000.

- Form 990, the IRS form required for larger tax-exempt organizations with annual gross receipts over $200,000 or total assets over $500,000. This is the longest form that requires the most detailed information to complete.

- Form 990-PF, the form completed by all private foundations, regardless of their financial status. Organizations that might complete this form include Section 4947(a)(1) nonexempt charitable trusts and Section 501(c)(3) tax-exempt private foundations.

Knowing the fiscal size of your nonprofit is the best indicator of which form to use. As this guide is aimed at small-to-mid-sized nonprofits, we’ll be focusing on Forms 990-N and 990-EZ going forward.

Forms 990-EZ vs 990-N FAQs

What are the differences between Forms 990-EZ vs 990-N?

Though both forms are aimed at small nonprofits, there are several key differences in their filing processes and requirements, such as:

.png?width=1600&height=1200&name=990-ez%20vs%20990-n_differences_1%20(1).png)

Filing prerequisites

- 990-EZ: Gross receipts of between $50,000 and $200,000

- 990-N: Gross receipts of under $50,000

Required information

- 990-N: Basic information about the nonprofit, such as

- Contact information

- Proof of gross receipts and confirmation that they are under $50,000

- Your nonprofit’s Employer Identification Number (EIN) and the organization’s Taxpayer Identification Number (TIN)

- The tax year you are filing in

- The legal name and mailing address for the organization

- Any other names the organization may use

- The name and address of the principal officer

- The URL for the organization’s website

- If applicable, a statement if the organization has gone out of business or is going out of business

- 990-EZ: All of the above information, plus details such as:

- Detailed breakdown of fundraising activities

- Statement of expenses and income

- Program accomplishments

- The purpose of the nonprofit

- Unrelated business income breakdown

Required schedules

Schedules are addendums to the original Form 990 required for certain nonprofits. Their purpose is to provide additional context for some financial situations nonprofits might find themselves in. You can read the full list of schedules here.

- 990-EZ: A and B are required, whereas C, E, G, L, N, and O might be required.

- 990-N: None are required.

Extensions

- 990-EZ: Six-month extension available by completing Form 8868.

-

990-N: None are granted.

Late filing fines

- 990-EZ: There’s a penalty of $20 per day for each day the return is late. The maximum penalty is $12,000, or five percent of the organization's gross receipts, whichever is less.

990-N: There’s no penalty, but nonprofits that fail to file for three consecutive years will automatically lose tax-exempt status.

What are the similarities between Forms 990-EZ and 990-N?

Keep these similarities between the two forms in mind as you determine which one you’ll need to file:

.png?width=1600&height=1100&name=990-ez%20vs%20990-n_similarities%20(1).png)

Deadlines

Both forms are due on the 15th day of the fifth month after filing at the end of the filing year. For example, if your fiscal year ended in January of 2024, your due date for your IRS Form 990 would be June 15th, 2024. If your due date happens to fall on a Saturday, Sunday, or a government holiday, the deadline will be the next business day.

Filing channel

Both forms must be filed online through the IRS portal. Nonprofits must make either an ID.me or Login.gov account to sign into this portal (both accounts are the same except Login.gov is connected to other programs, like Social Security).

Online-only

No matter which form you decide to file, submitting your forms online using an authorized e-file provider (or software that facilitates filling out the forms) is required by the IRS. However, not all e-file providers are created equal. We’ll review some top providers and features to look for in a later section.

Public disclosure requirements

All types of Form 990 are a matter of public record. Once your form is uploaded and approved, the IRS will display it in this database. However, this can be an asset in enhancing your nonprofit’s transparency with potential supporters.

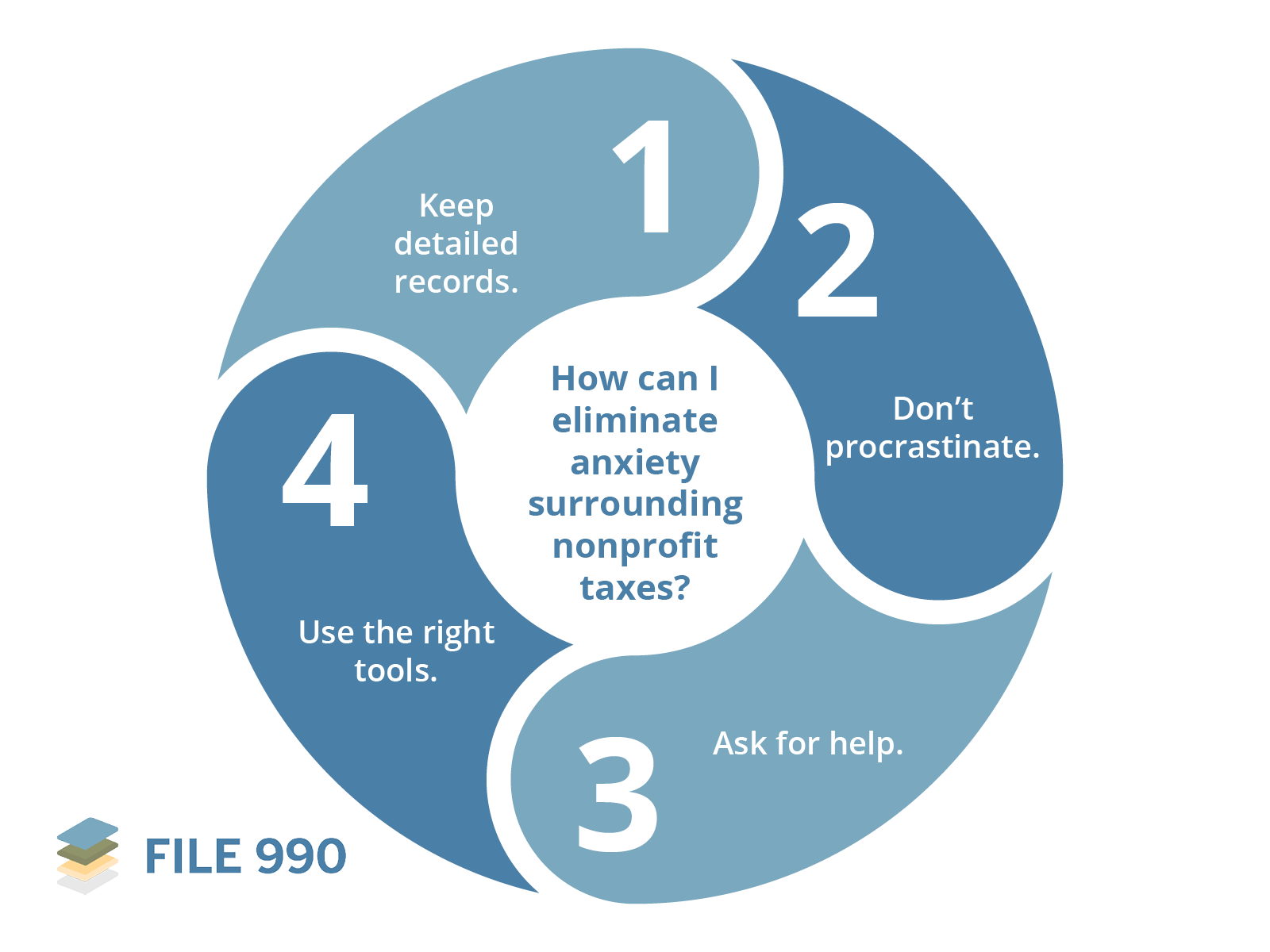

How can I eliminate anxiety surrounding nonprofit taxes?

Tax filing can be daunting even for seasoned nonprofit professionals. However, keeping a clear head is crucial to making the nonprofit tax filing process organized and efficient. By ensuring that your revenue, expenses, and changes in net assets are correct throughout the year, the form becomes a simple plug-and-play—but only with these four best practices:

1. Keep detailed records.

Think about all the records your nonprofit uses to fill out tax forms (and how much time it would take to compile them). Storing this information in a database will make tax season much easier for your nonprofit. Here are some tips for keeping detailed records:- Append important supporter data, such as contact information.

- Use a database made for nonprofits.

- Understand which data is most important for you to track.

- Conduct regular database audits to remove unhelpful information.

You might think the more detailed your data is the better, but don’t make your life harder with overcomplicated collection practices. Streamline your efforts with software that offers customizable fields and data syncing between systems.

2. Don't procrastinate.

As a nonprofit professional, you have a lot on your plate already. Plan your approach to your tax season well in advance to prevent a hectic experience down the line.

Filing sooner rather than later helps eliminate surprises and ensures you complete the process before your deadline. Although you won’t be able to file your tax forms until after your tax year ends, it’s a good idea to get your finances in order beforehand to make the filing process as simple as possible when the time arrives.

3. Ask for help.

Your organization may have access to more resources than you know. The only way to find out is to ask! Here are some ways you can ask for help during the filing process:- Ask your community. You may have donors or volunteers who are Certified Public Accountants (CPAs) willing to help you file. Send out an appeal to your supporters asking if anyone is interested in helping you with your tax forms. They might even do pro bono work due to their existing connection to your organization!

- Outsource the work to a consultant or accountant. These individuals can supplement where you’re lacking in financial strategy and ensure your organization files your tax forms correctly. However, they often come with a hefty price tag.

- File yourself. Small to mid-sized organizations can usually file their own forms without the assistance of an external accountant—especially when equipped with the tools and resources they need for success.

4. Use the right tools.

The best way to keep your data organized, actionable, and secure is to use software that helps you adhere to data hygiene best practices. For instance, you might use systems like these to help with filing taxes:- Nonprofit tax filing software, like File 990

- Accounting software

- A CRM

As far as authorized IRS e-file providers go, there are many options on the market, but we recommend File 990. It streamlines your tax journey and is designed specifically for tax filing assistance for small to mid-sized nonprofits.

All you need to get started is your organization’s EIN, and our tax software automatically pulls relevant information from the IRS database. Plus, we’ll carry your nonprofit’s data over from year to year, effectively minimizing the information you’ll need to gather manually and mitigating the risk of human error.

By investing in a tool like File 990 to file Form 990-N or 990-EZ on your own, you can save money that you would otherwise have spent on outsourcing to an accounting firm.

Wrapping Up

Now that you know the nuances of Forms 990-EZ and 990-N and which is right for your organization, it’s time to get to filing. Remember, File 990 takes the anxiety and errors out of annual tax filing for your organization. That way, you can save your team’s valuable time and resources for what really matters: achieving your mission.

Additional Resources

For more information on nonprofit taxes, effective e-filing practices, and choosing the right form for your organization, be sure to check out our other educational resources:

- An Ultimate Guide to the 990-N Postcard for Small Nonprofits. Still not sure if the 990-N postcard is right for your organization? Skim through this guide to find out more.

- 990-EZ for Nonprofits | Everything You Need to Know to File. This comprehensive guide to Form 990-EZ will help you navigate the filing process with ease.

- The IRS Form 990-EZ Deadline & What Happens When You Miss It. There can be significant penalties for filing your Form 990 variants late. Learn about filing deadlines here so you never miss them.

Written by Bradley Olson

Bradley Olson is the Marketing Manager at File 990, a leading nonprofit tax filing solution for small and mid-sized nonprofits. Bradley is passionate about providing nonprofits with straightforward solutions to complicated tax-filing challenges, which empowers them to achieve their missions and establish themselves in their communities. Bradley’s 15 years of marketing experience and 25 years working for for-profit and nonprofit verticals set him apart as a thought leader in nonprofit tax filing.

.png?width=1500&height=700&name=990-ez%20vs%20990-n_large%20CTA%20(1).png)