As a nonprofit professional, you’re familiar with the yearly maintenance that ensures your organization’s continued success: filing Form 990 with the IRS.…

read more501(c)(3) Status Revoked? Here’s How to Recover Easily

Filing Form 990 is an essential—or, depending on your point of view, inevitable—part of nonprofit governance. However, filing your tax forms accurately…

read more990-EZ vs 990-N: How to Tell the Difference + Other FAQs

One of your small nonprofit’s most significant duties is filling out your IRS tax forms. Not only does filing these forms on time maintain your…

read moreDo I Need a Tax Accountant for My Nonprofit?

It’s officially tax season. You know, that time of year that some people dread, others don’t mind, and a few even get excited about. And, not only are you…

read moreDoes My Nonprofit Have to Pay Taxes?

As a United States citizen, you are legally required to file your personal taxes annually; and this is regardless of your financial situation, or whether…

read moreWait, I Have to File Form 990 Electronically? Updates on New IRS Rules.

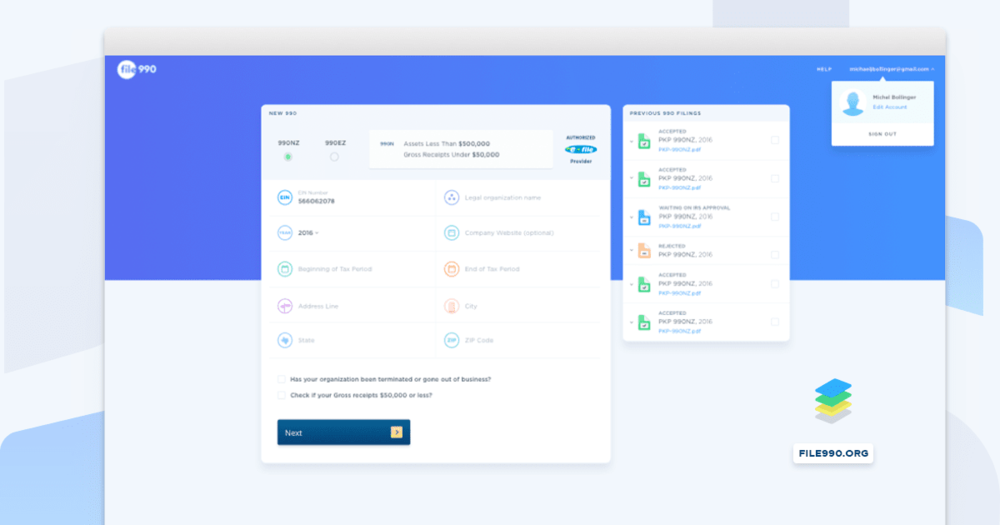

A change in the form 990 instructions for nonprofits filing in 2020 will require you to file your form 990 electronically. Previously, organizations have…

read moreI Need to File a Form 990 Extension!

Nobody wants to file a form 990 extension. Nonprofit financial officers have a lot on their plates. Pushing back deadlines only compounds the tasks you…

read moreNon Profit Treasurer: Ask Yourself These Questions Before Filing Your 990

If you’re a non profit treasurer, filing your 990 tax forms is one of many tasks you perform. You’re charged with managing and maintaining your…

read moreWhy is the 990 N Called the e-Postcard?

A postcard is nothing new. In fact, the first government-produced postcard in the United States was issued on May 1, 1873. Over the past 146 years,…

read moreHow Many Different 990 Forms Are There?

Filing an IRS nonprofit 990 form is the least favorite pastime of most people, unless you’re a CPA or a certified e-filer for nonprofit organizations like…

read more