Do I Need a Tax Accountant for My Nonprofit?

March 31, 2020 | 990 filing | 0 Comments

It’s officially tax season. You know, that time of year that some people dread, others don’t mind, and a few even get excited about. And, not only are you legally required to file your own taxes, if you are the treasurer for a non-profit organization, you will need to file Form 990. If your organization is tax-exempt, then it should have been classified as such, after filing Articles of Incorporation.

Maybe you’re feeling really confident about the Form 990 instructions. You’ve done it before, or perhaps you simply believe that this will be as easy as doing your personal taxes. But, if your organization’s finances have changed, then you wouldn’t necessarily be filling out the form in the same way. (The IRS could, if it so desires, amend the form).

So, even if you think you’re a professional when it comes to Form 990 instructions, it can be much more difficult to manage your nonprofit’s finances than you might think.

Form 990 Instructions

Form 990 is an essential form for all non-profit organizations, as it enables your organization to maintain its tax-exempt status. Form 990 also serves as a public document viewable by your organization’s stakeholders and donors.

When it comes time to file Form 990 for your non-profit organization, be sure to use the correct form and follow the Form 990 instructions. If you are a small nonprofit whose annual gross receipts are $50,000 or less, then you will be filing Form 990-N, also known as an electronic postcard.

Despite being the easiest form — especially compared to the full-version Form 990 — Form 990-N comes with its own challenges, and can be intimidating to even the most seasoned non-profit treasurer. Also, as it is not available in physical form, anyone who is unfamiliar with the e-filing system may require assistance.

Here is what you need in order to follow the Form 990 instructions:

- The EIN (Employer Identification Number)

- The organization’s legal name and mailing address, as well any other names the organization currently uses

- The principal officer’s name and address

- The tax year for which you are filing Form 990

- The organization’s website, if applicable

- Confirmation that the organization’s gross receipts are $50,000 or less

- And, if the organization has gone or is going out of business, a statement describing this

Keep in mind: as a result of a recent change, all non-profit organizations must now file Form 990 electronically. Under the Taxpayer First Act enacted in July of 2019, all organizations with tax-exempt statuses must e-file their taxes, starting this year, in 2020.

For most organizations–whose tax years end in December — Form 990 will be due on May 15th, a month later than your personal taxes are due. But, still, this date will creep up sooner than you’d like or expect.

What is a Tax Accountant?

A tax accountant can help you when it is time to follow Form 990 instructions. You may be, for whatever reason, unable to file Form 990 yourself. In this instance, it is essential to ensure that board members and other relevant individuals are in the loop and on the same page. One or more of them might be able to file Form 990, but even those who are willing to step up may not be capable of doing so themselves. That’s when you can call on a tax accountant.

A tax accountant may also be able to help you with your organization’s budget, which needs to effectively consider both cash inflow and outflow. Even if you have been adamant about keeping solid financial records, a tax accountant could help you organize and make sense of it all.

The question you might ask yourself is: do I need a tax accountant for my small nonprofit? Well, that’s something only you and others involved in your organization can answer. Maybe the Form 990 instructions are too stressful and confusing. Or maybe you just need someone with more financial experience than the current treasurer possesses.

Once you’ve decided to obtain a tax accountant for your non-profit, you need to find the right tax accountant — which can depend on what type of services your organization requires.

You want to be sure to file Form 990 and other relevant documents on time. Failing to file these taxes for three consecutive years or more can lead to your organization’s losing its tax-exempt status. The best thing to do is to be as prepared as possible and to be cognizant of the approaching deadline so it does not sneak up on you. It is possible to file for an extension, but this can be tedious and unreliable.

Unfortunately, even if you take every step to ensure that you file on time, things can happen. Maybe there was a major shake-up in your non-profit organization, or some expenses that went unnoticed. Or maybe you just don’t want to feel stressed out when abiding by Form 990 instructions.

How Tax Software Can Help with Form 990 Instructions

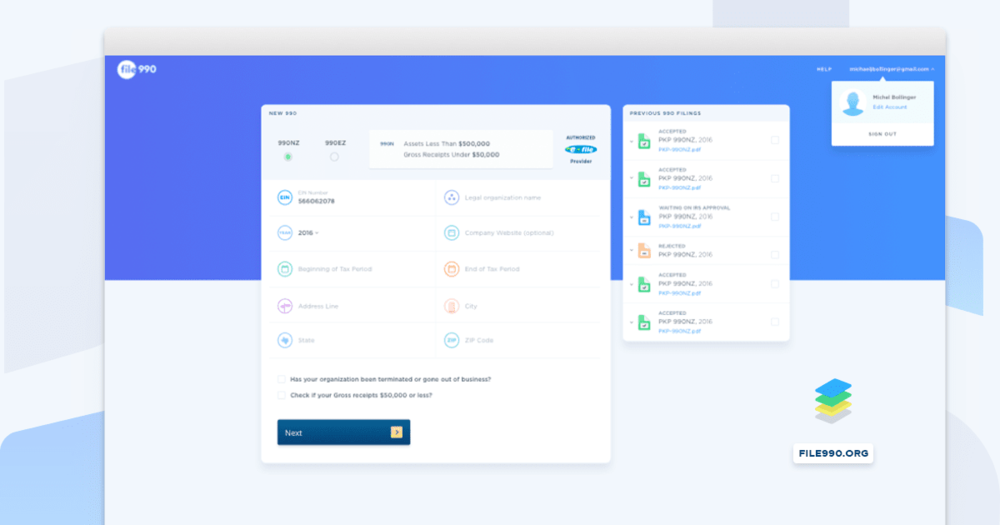

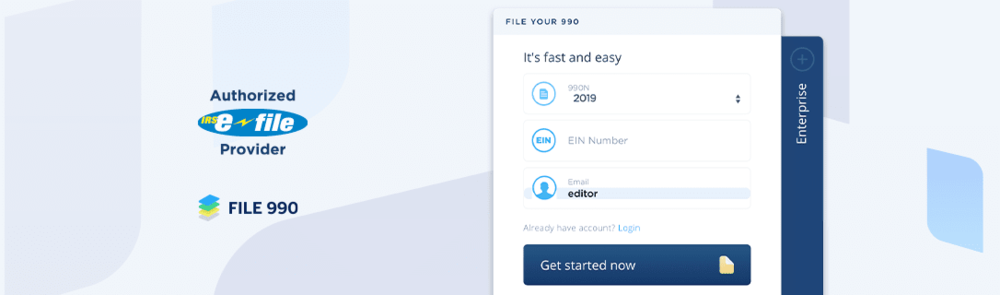

File990 is a certified e-filer and approved by the IRS to assist non-profit organizations in following Form 990 instructions. While you might have a tax accountant who can help you in this regard, it certainly doesn’t hurt to use nonprofit tax software to make things even less stressful for you and your organization.

File990 is the ideal platform to file Form 990-N in particular, as you can easily fill out and submit the form in minutes — and do so in the most secure manner.

Also, File990 will also provide you with yearly reminders to file your non-profit organization’s tax return, thereby making it unlikely that you will miss the deadline.

Of course, just because you can file a 990-N online doesn’t mean it is easy to do. Once you have completed the Form 990 instructions via File990, it is immediately sent to the IRS. There is no waiting period.

File990 utilizes the highest level of security to protect all of your sensitive information, and an equal level of security is used when submitting your tax forms to the IRS. Some online tax services lack the necessary level of security, which is essential when it comes to finances.

Have questions or want to learn more about File990’s services? (859) 309-3641 / info@file990.org.

Written by Admin