990EZ for Nonprofits | Everything You Need to Know to File

November 28, 2023 | 990-EZ, non profit taxes, 990EZ | 0 Comments

One of the key benefits of running a 501(3)(c) nonprofit is the tax exemption that comes with it. But once you’ve filed your Form 1023 and been granted tax-exempt status by the IRS, is your organization good to go forever? Not so fast.

Each year, eligible nonprofits must file certain tax forms to maintain their tax exemption: typically, the Form 990 or one of its variations. Today, we’re talking about the IRS Form 990’s little brother—the 990EZ, also known as 990 EZ and 990-EZ. The Pepsi Zero to the IRS Form 990’s Original Pepsi, if you will.

And although taxes aren’t exactly fun, as a tax-exempt organization, it’s critically important to make sure you’re filing these forms correctly and on time if you want to avoid a run-in with Tax Man Uncle Sam come May.

With that said, this handy guide contains a complete breakdown of the IRS Form 990EZ and everything you need to know to file for your organization. Specifically, we’ll answer the following questions:

- What is a 990EZ?

- Who qualifies for the 990EZ?

- When is my 990EZ due?

- Where do I file Form 990EZ?

- How do I file my nonprofit's Form 990EZ?

If the IRS is known for anything, it’s certainly not its simplicity, easy-to-understand instructions, and award-winning customer service. That’s where tax software and other financial services can really come in handy to make sure you’re doing what you can for your organization.

Ready to learn more about the 990-EZ? Let’s get started!

What is a 990EZ?

The 990 EZ is an annual tax information filing completed by many organizations that fall under the 501(c) series of statuses of the tax code, exempting them from the duty of paying taxes. The 990EZ is just one type of 990, offered for small to mid-sized nonprofit organizations.

For nonprofits like yours, all of your funds will be reinvested in your mission. That’s what it means to be a nonprofit. You don’t make a profit. Therefore, any taxes the government were to take out would only take away from your mission, and they don’t want to do that. The U.S government willfully allows billions of dollars to go uncollected for organizations like yours to help make the world a better place.

The annual tax forms for nonprofits, including the 990-EZ, ensures that organizations don’t take advantage of this system and “reinvest” the money earned into themselves as a non-taxed profit. The government simply wants to ensure that there is a good reason they’re not collecting tax money from nonprofit organizations, which is what the IRS Form 990 EZ helps them figure out

That’s why the second page of the 990EZ asks the question:

What is the organization’s primary exempt purpose?

There may not be a ton of space offered for the answer, but the point is that the federal government wants to make sure that you’re working towards a valuable mission before they let potential tax dollars slip by.

Throughout this four-page form, there are other questions that the IRS asks to gain additional insights into your organization’s mission and financial situation. In addition to the primary question above, they’ll ask you for detailed information regarding:

- Your mission

- Significant activities you’ve completed

- Revenues

- Expenses

- Assets

- Liabilities

And then, on top of that information, you should keep an eye out for a dedicated list of “schedules” that might also need to be filled out. If your organization meets certain criteria, the IRS might ask for supplementary information to fill in some of the gaps. For example, keep an eye out for schedules such as:

- Schedule of Contributors (a list of your contributors)

- Schedule D to provide more details regarding your financial statements

- Schedule F to report activities that occur outside of the country

- Schedule G to describe your organization’s fundraising activities

We know, this seems like a lot. And the truth is that there are even more schedules that your organization should keep in mind as you file your tax forms. With all this information required of your organization, you know the IRS is serious about providing tax exemption only to the organizations who can demonstrate their dedication to the cause

So, take the filing just as seriously as the IRS if you want to keep your tax-exempt status. The federal government isn’t simply handing it out—they expect you to prove why you deserve it.

Tip: When you’re filing the required information in your 990-EZ, be sure to complete all requested information to the best of your ability. The IRS isn’t shy about returning incomplete forms or requesting additional information if you don’t provide everything they need on the first attempt. They’ll send your filing back to you with a Letter 2695 Returning Form 990 EZ due to Missing Information and require you to resubmit the form to avoid any penalties.

Who qualifies for the 990EZ?

If your organization is a 501(c)(1), 501(c)(2),501(c)(3) … 501(c)(29), you have to file to maintain your tax-exempt status. The end.

(Well, not exactly “the end.” There are some special organizations like religious institutions or political organizations that don’t need to file every year, but chances are, you probably don’t fall under this special category.)

If you fail to file, you run the risk of losing your tax-exempt status and will have to reapply, meaning you’ll be responsible for paying taxes on your organization in the interim. And that’s no fun at all.

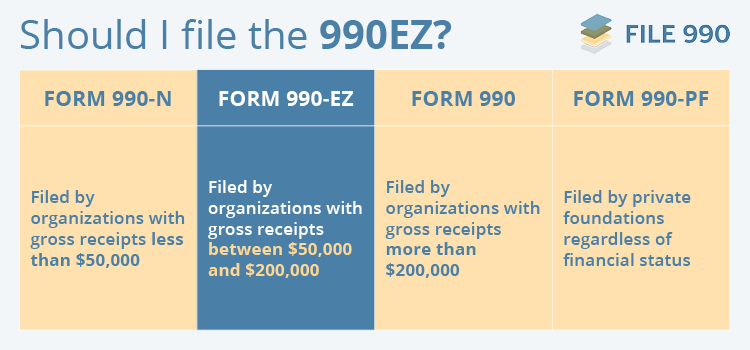

When it comes to filing, there are several tax forms in the series of Form 990s. There is the standard Form 990 (an eight-page form), Form 990-EZ (the four-page form we’re discussing), and the 990-N (an eight-question form designed for the smallest of organizations).

As the middle form of the three, your organization qualifies for the 990 EZ if it’s considered small to medium-sized. Luckily, the IRS has defined the qualities that make an organization “small to medium-sized.”

Your organization can file the Form 990EZ if you have less than $200,000 in gross receipts or less than $500,000 in total assets.

- Are your gross receipts $200,001? Sorry, you have to file the standard Form 990.

- What if your gross receipts are $199,999? Congratulations! You can file the Form 990-EZ.

- Do you have real estate that’s worth $600,000? Sorry, you have to file the standard Form 990.

- What if your real estate is worth $400,000? Congratulations! You can file the Form 990 EZ.

The Form 990EZ is very similar to the IRS 990, just shorter and simpler. If you don’t qualify for the form, that’s fine! You’ll just need to file the standard Form 990. But if you do qualify, kiss your lucky rabbit’s foot because life just got a little easier.

Tip: When you file your Form 990-EZ, don’t include any personal information in your filing. One study found that 18% of organizations between 2001 and 2006 included at least one social security number on their Form 990. Don’t follow their lead. These documents are public, so identifying information such as this leaves these individuals open to fraud.

When is my 990EZ due?

The simple answer to the question of your 990 EZ due date is the 15th day of the 5th month after your fiscal year ends.

For organizations on the calendar fiscal year (the one starting January 1st and ending December 31st), this means your Form 990 is due on May 15th.

If you’re on a different fiscal year, you can do the math to determine your due date. For example, if your fiscal tax year ended in April, you would file your taxes on September 15th.

If you didn’t have a due date or consequences for missing the deadline, would you complete your forms on time? If you say, “yes,” then you’re probably in the minority. Most of us need something to hold us accountable to meet these types of deadlines, which is why the IRS tied late filings to a punishment.

So, what happens if you forget to file the IRS Form 990-EZ or file late?

If you file late or forget to file, your organization will be imposed a penalty of $20 per day the return is late with a maximum penalty of $10,000 or 5% of your gross receipts (whichever is less).

AND

If you forget to file for three consecutive years, you’ll lose your exempt status and need to reapply again. This means paying filing fees and paying taxes until you’re reestablished as a 501(c) organization

Sounds expensive right?

Luckily, if you’re worried about making your deadline, you can always ask for an extension to file. As inflexible as the IRS may seem, they’re actually pretty understanding if you give them sufficient heads-up that you won’t make the deadline. You can give them notice by filing a Form 8688 before your deadline. This adds an additional six months to your original tax filing due date.

Often, this is something your organization might choose to do if you’re conducting a financial audit. This enables you to go through all auditing steps in the beginning of the year and incorporate all the next steps defined during the auditing process before filing annual tax forms.

Tip: If you make over $100,000 in gross receipts, you won’t be filing the Form 990 EZ, but you should keep in mind that the penalties for late filings become much more expensive. For these organizations, the penalty increases to $100 per day receipts are filed late with a maximum charge of $50,000.

Where do I file Form 990EZ?

After the First Taxpayer Act passed, all nonprofits filing their tax forms for a tax year beginning after July 1st, 2019 must file electronically. While nonprofits had the option before to file their 990-EZ or standard Form 990 either electronically or physically, it’s now the standard practice to file entirely electronically.

While you could do this all from the IRS website, we’ve mentioned before that the IRS isn’t exactly known for providing the most intuitive processes. It’s likely to be much easier to file electronically through an authorized e-filing provider.

File 990 offers intuitive filing software to help organizations like yours file their Form 990EZ or Form 990-N.

By answering a few simple questions, the right software solutions will automatically fill in the proper items on the form, making the filing process much simpler for your organization.

Plus, Form 990 software will also save your forms from previous years, making it easy to organize your past forms, reference important information, and even auto-fill some of the questions that carry over from year to year. Not to mention the fact that many e-filers offer notifications to remind you of the due dates for your forms so that you’re never late.

If you’re looking for the best e-filer on the market, File 990 has you covered. Get started today!

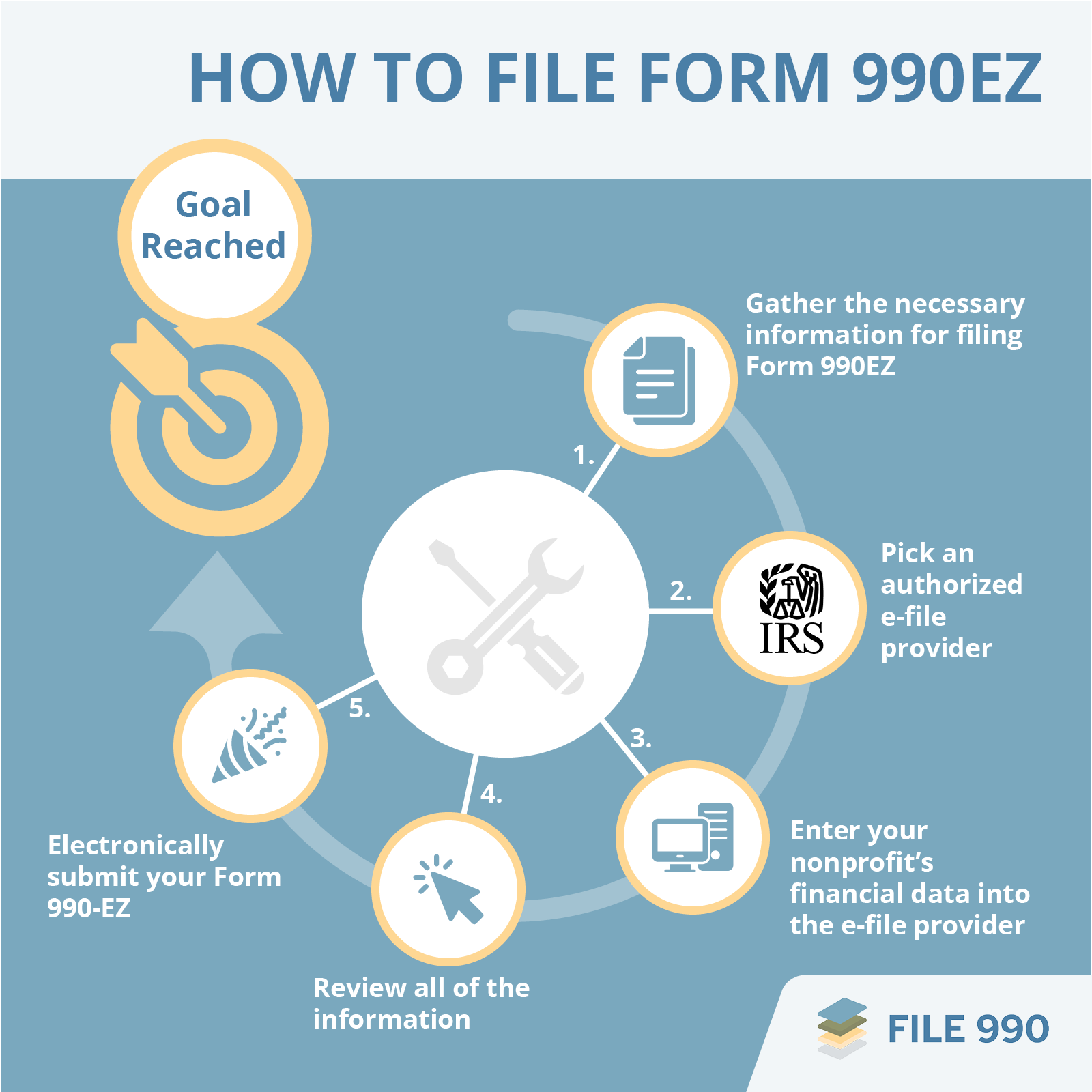

How do I file my nonprofit's Form 990EZ?

1. Gather the necessary information for filing Form 990EZ

Before starting the Form 990EZ filing process, File 990 suggests collecting your nonprofit’s:

- List of upper officers, members of the Board of Directors, and staff

- Employer Identification Number (EIN)

- Address

- List of grants, donations, and other revenue sources

- Prior tax filings

Remember that you’ll need additional information to round out Form 990 EZ if you’re filing additional schedules, such as an in-depth explanation of certain fundraising efforts or activities conducted in other countries.

2. Pick an authorized e-file provider

Since all nonprofits have been required to file Form 990 EZ electronically, you’ll need to find an e-file software solution that fits your nonprofit’s needs. Ensure that your provider:

- Can file all required schedules in addition to Form 990-EZ

- Aligns with your budget

- Follows data security regulations

- Is authorized by the IRS and can file tax forms in your state

- Has robust support resources

- Can pull data from previous years’ tax forms

- Saves data from previous filings for reuse in the future

If you don’t already have a solution in mind, we recommend File 990, an authorized e-file provider with all of these features that streamlines the filing process significantly.

Otherwise, the IRS’ list of authorized e-file providers can help you get started. Once you’ve determined your top option, make an account and provide any necessary information, including tax forms from previous years.

3. Enter your nonprofit’s financial data into the e-file provider

This is where the process can become complicated! To ensure the accuracy of your forms:

- Take breaks between sections to regroup and check your work

- Don’t multitask with other forms and schedules

- Use checklists to ensure you’ve included all required information

- Save your progress after each section

- Verify consistency across sections

- Understand your e-file provider’s capabilities and reach out to the support team if needed

Filing Form 990 EZ is a big undertaking, but breaking it down into more manageable tasks and consistently verifying that all of the information is accurate can help the process run smoothly.

4. Review all of the information

Once you’ve inputted all relevant information, it’s almost time to submit your Form 990-EZ! Thoroughly check your work and recalculate any equations multiple times until you’re positive that everything is ready.

Bonus tip: File 990 flags where information is missing and other discrepancies so you can submit Form 990 EZ as soon as possible!

5. Electronically submit your Form 990-EZ

Now’s the moment you’ve all been waiting for—sending your Form 990EZ to the IRS through your e-file provider! Remember to file your Form 990 EZ with plenty of time to spare so you can rectify any issues with your submission and remain in good standing with the IRS.

Wrapping Up

The 990 EZ is like the little brother of the standard Form 990, but that doesn’t mean it’s less important! Understanding why you have to file, the consequences of not filing, and even which form will be best for you to file are all necessary to ensure you’re ready for this upcoming tax season.

If you’re looking for more information about filing annual tax forms and nonprofit tax season, do some additional research with the resources below:

- 990-N vs. 990 EZ: What’s the Difference? [+ Top Tips]: Learn more about the 990-EZ as well as the 990-N with this guide. Dive into the differences between the two and better understand how to choose which one you need to file.

- Can My Nonprofit File a 990 Postcard?: If you don’t file the 990EZ, you might be eligible to file the 990-N. Learn more about the postcard in this comprehensive guide.

- Why Should You E-File Your 990?: Some organizations still have the option to file their 990 using a physical form rather than online. However, we firmly believe that online filing is the better option. Learn why with this guide.

Written by Bradley Olson

Bradley Olson is the Marketing Manager at File 990, a leading nonprofit tax filing solution for small and mid-sized nonprofits. Bradley is passionate about providing nonprofits with straightforward solutions to complicated tax-filing challenges, which empowers them to achieve their missions and establish themselves in their communities. Bradley’s 15 years of marketing experience and 25 years working for for-profit and nonprofit verticals set him apart as a thought leader in nonprofit tax filing.